Our Trading Room is the perfect place to

Accounting and Finance BSc(Hons)

Start Dates

21 September 2026

Duration

3 years full-time 4 years inc. placement year

UCAS Tariff

120-112

Overview

Why choose Huddersfield for this course?

- Apply your finance skills from day one in real-world projects and our state-of-the-art Trading Room.

- Professional accreditation with CIMA, ICAEW and ACCA supports your career progression.

- Optional 48-week placement gives hands-on experience and expands your professional network in the UK or abroad.

Accreditation and Professional Links

Recognised connections to give you an extra edge when you graduate. Read More

Ready to kickstart a potentially exciting career in the expanding world of accounting and finance? An Accounting and Finance BSc(Hons) degree can set you up for success with a rounded education in financial management and business economics. You’ll study a wide range of subjects including:

- Financial accounting and management accounting

- Banking and financial markets

- Business development and business finance

You’ll also learn your trade and work in a real-life, state-of-the-art trading room, which simulates the real stock market.

Why study Accounting and Finance BSc(Hons)

You’ll be studying at an AACSB International-accredited Business School. Globally, fewer than six per cent of institutions offering business degrees achieve this accreditation. Additionally, to ensure our graduates gain exemptions from several professional exams and are equipped with essential skills and knowledge in business operations and financial management, this course is professionally accredited by:

- The Chartered Institute of Management Accountants (CIMA)

- The Institute of Chartered Accountants in England & Wales (ICAEW)

- The Association of Chartered Certified Accountants (ACCA)

You’ll benefit, too, from guest lectures from professionals with varied expertise in, for example, accounting, finance, and financial services.

After the second year of the course, you’ll put your knowledge and skills to the test in an optional 48-week work placement in your area of interest, in the UK or abroad, utilising our links with local, national, and international companies throughout many industries. The top five job titles advertised in the UK for graduate roles associated with Accounting and Finance BSc(Hons) are Management Accountants, Assistant Management Accountants, Assistant Accountants, Finance Assistants, and Account Assistants.**

This course will prepare you for a variety of potentially exciting careers in a range of fields in the industry. You could work as a chartered accountant, an auditor, a business analyst, or a financial planner. You can even go on to work for non-profits, government agencies, banks or even insurance companies.

**Lightcast data extracted from Graduate Career Explorer – job postings from Dec 2023 to Nov 2024 showing jobs advertised associated with a selection of relevant graduate.

Career opportunities after the course *

Account Assistants

Finance Assistants

Assistant Accountants

Assistant Management Accountan

Account Managers

*Lightcast

Entry Requirements

BBB-BBC at A Level.

DDM-DMM in BTEC Level 3 Extended Diploma.

120-112 UCAS points from a combination of Level 3 qualifications.

Access to Higher Education Diploma with 45 Level 3 credits at Merit or above.

Merit at T Level

120-112 UCAS tariff points from International Baccalaureate qualifications.

If your first language is not English, you will need to meet the minimum requirements of an English Language qualification. The minimum for IELTS is 6.0 overall with no element lower than 5.5, or equivalent. Read more about the University’s entry requirements for students outside of the UK on our International Entry Requirements page.

Other suitable experience or qualifications will be considered. For further information please see the University's minimum entry requirements.

Course Details

You will also choose 2 optional modules in this year. The current optional modules are:

For more information on when and how we update our modules please see the ‘Legal Information’ section below.

The course offers an optional one-year (48 weeks) work placement after the second year, in the UK or abroad.

You will also choose 2 optional modules in this year. The current optional modules are:

For more information on when and how we update our modules please see the ‘Legal Information’ section below.

Teaching and Assessment

Discover what to expect from your tutor contact time, assessment methods, and feedback process.

Global Professional Award

At Huddersfield, you’ll study the award-winning Global Professional Award (GPA) alongside your degree* — so you’re ready for the career you want, whatever subject you choose.

Placements

The course offers an optional one-year (48 weeks) work placement after the second year, in the UK or abroad.

Our Placement Office works with national and international employers to ensure excellent work experience opportunities are available to you on placement courses as well as giving advice in areas such as interview skills and preparing CVs and covering letters.

Previous placement providers have included Audit Partnership, Brosnans Chartered Accountants, Capita: Yorkshire Bank, Certis Accountants, DHL, Enterprise Rent-a-Car, H Accountancy, Haines Watts Leeds LLP, Kirklees Council, Lloyds Banking Group, L’Oréal, NHS England, PPG Architectural Coatings EMEA, Redmayne Bentley Stockbrokers, Rolls Royce, SA Chopdat Chartered Accountants, Sigma Chartered Accountants and Tax Advisors, Smart Accounts and Tax, The Symphony Group, Thornton and Ross, Walker and Sutcliffe Chartered Accountants and West Yorkshire Accountancy Services.

The placement year is a valuable tool that can enhance your employability and help you to develop as an individual. It is acknowledged that graduates with industry experience are generally much more attractive to employers.

I chose to do a placement as I knew the job market is tough, and I wanted to make sure I had some extra experience that will put me ahead in the job market. This placement has given me a clearer perspective on what I enjoy and where my key strengths are so I can pursue them further

- Omar Kaf Al-Ghazal

Placement Student, Enterprise Rent-A-Car

Your Career

Previous graduates from this course have gone in to roles such as Operations Analyst, Finance Manager, Assistant Fund Accountant, Assistant Accountant as well as entering into professional accountancy training contracts with companies such as PwC, Lloyds Banking Group, GE Capital, KPMG, The Department for Work and Pensions, Jaguar Land Rover, Bonmarche, DePuy International, Stagecoach and Bradford NHS Trust, to name but a few.

85%

of graduates from this subject who are in work and/or further study fifteen months after graduating.

* HESA Graduate Outcomes 21/22, UK domiciled graduates, other activities excluded.

I have always had a keen interest in business and maths and accounting and finance was the right option for me. I had an entirely positive experience while studying and the support and opportunities presented to me throughout my degree shaped my career decisions when I left the university.

- Rohail Ahmed

Studied Accounting and Finance BSc(Hons). Currently works as a Solutions Design Manager at DHL Supply Chain.

Our graduates work at some of the world's biggest companies.

Fees and Finance

This information is for Home students applying to study at the University of Huddersfield in the academic year 2026/27.

Please note that tuition fees for subsequent years may rise in line with inflation (RPI-X) and/or Government policy.

From January 2027 the UK government is launching a new student funding system for people starting university education. Read more about the Lifelong Learning Entitlement (LLE).

For detailed information please visit https://www.hud.ac.uk/study/fees/

This information is for international students applying to study at the University of Huddersfield in the academic year 2026/27.

Please note that tuition fees for subsequent years may rise in line with inflation (RPI-X) and/or Government policy.

For detailed information please visit https://www.hud.ac.uk/international/fees-and-funding/

Home

The tuition fee for a placement year is £1000. If you go on work experience or work placement, you will need to fund your own travel and/or accommodation costs to and from the placement. Please be aware that if your placement is outside of the UK, you will still be responsible for your travel and living expenses and may need to consider issues like health care and insurance costs.

International

The tuition fee for a placement year is £3,300. If you go on work experience or work placement, you will need to fund your own travel and/or accommodation costs to and from the placement. Please be aware that if your placement is outside of the UK, you will still be responsible for your travel and living expenses and may need to consider issues like health care and insurance costs.

Scholarships and Bursaries

Discover what additional help you may be eligible for to support your University studies.

Tuition Fee Loans

Find out more about tuition fee loans available to eligible undergraduate students.

What’s included in your fee?

We want you to understand exactly what your fees will cover and what additional costs you may need to budget for when you decide to become a student with us.

If you have any questions about Fees and Finance, please email the Student Finance Team.

Gallery

Take a look at the Charles Sikes Building, where your lectures and seminars will take place.

Explore More

Why Hud

Explore the unique opportunities and resources that make our institution a top choice for students seeking a well-rounded and future-focused education.

More Info

Careers support

We know you’re coming to university to study on your chosen subject, meet new people and broaden your horizons. However, we also help you to focus on life after you have graduated to ensure that your hard work pays off and you achieve your ambition.

Find out more about careers supportStudent support

At the University of Huddersfield, you’ll find support networks and services to help you get ahead in your studies and social life. Whether you study at undergraduate or postgraduate level, you’ll soon discover that you’re never far away from our dedicated staff and resources to help you to navigate through your personal student journey.

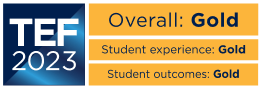

See our support servicesTeaching Excellence

Great teaching is engaging and inspiring — it helps you reach your full potential and prepares you for the future. We don’t just teach well — we excel — and we have the awards and recognition to prove it.

Find out moreInspiring Academics

Our researchers carry out world-leading work that makes a real difference to people’s lives. Staff within the Huddersfield Business School may teach you on this course.

Find out more about our staffResearch Excellence

You’ll be taught by staff who want to support your learning and share the latest knowledge and research.

Find out moreAccommodation

Looking for student accommodation? Huddersfield has you covered. HudLets has a variety of accommodation types to choose from, no matter what your preference. HudLets is the University’s approved accommodation service, run by Huddersfield Students’ Union.

Take a look at your optionsFurther Study

If you want to continue your learning beyond your undergraduate degree, there is a range of financial support available for postgraduate study, including discounts for Huddersfield graduates.

Discover postgraduate coursesLegal information

When you enrol as a student of the University, your study and time with us will be governed by our terms and conditions, Handbook of Regulations and associated policies. It is important that you familiarise yourself with these as you will be asked to agree to them when you join us as a student. You will find a guide to the key terms here, along with the Student Protection Plan.

Although we always try and ensure we deliver our courses as described, sometimes we may have to make changes for the following reasons:

Changes to a course you have applied for but are not yet enrolled on

If we propose to make a major change to a course that you are holding an offer for, then we will tell you as soon as possible so that you can decide whether to withdraw your application prior to enrolment. We may occasionally have to withdraw a course you have applied for or combine your programme with another programme if we consider this reasonably necessary to ensure a good student experience, for example if there are not enough applicants. Where this is the case we will notify you as soon as reasonably possible and if you are unhappy with the change we will discuss with you other suitable courses we can transfer your application to. If you do not wish to transfer to another course with us, you may cancel your application and we will refund you any deposits or fees you have paid to us.

Changes to your course after you enrol as a student

Changes to option modules

Where your course allows you to choose modules from a range of options, we will review these each year and change them to reflect the expertise of our staff, current trends in research and as a result of student feedback or demand for certain modules. We will always ensure that you have an equivalent range of options to that advertised for the course. We will let you know in good time the options available for you to choose for the following year.

Major changes

We will only make major changes to non-optional modules on a course if it is necessary for us to do so and provided such changes are reasonable. A major change is a change that substantially changes the outcomes, or a significant part of your course, such as the nature of the award or a substantial change to module content, teaching days (part time provision), type of delivery or assessment of the core curriculum. For example, it may be necessary to make a major change to reflect changes in the law or the requirements of the University’s regulators or a commissioning or accrediting body. We may also make changes to improve the course in response to student, examiners’ or other course evaluators’ feedback or to ensure you are being taught current best practice. Major changes may also be necessary because of circumstances outside our reasonable control, such as a key member of staff being unable to teach due to illness, where they have a particular specialism that can’t be adequately covered by other members of staff; or due to pandemics, other disasters (such as fire, flood or war) or changes made by the government.

Major changes would usually be made with effect from the next academic year, but may happen sooner in an emergency. We will notify you as soon as possible should we need to make a major change and will consult with affected groups of students and any changes would only be made in accordance with our regulations. If you reasonably believe that the proposed change will cause you detriment or hardship we will, if appropriate, work with you to try to reduce the adverse effect on you or find an appropriate solution. Where an appropriate solution cannot be found and you let us know before the change takes effect you can cancel your registration and withdraw from the University without liability to the University for any additional tuition fees. We will provide reasonable support to assist you with transferring to another university if you wish to do so and you may be eligible for an exit award depending on how far through your course you are.

In exceptional circumstances, we may, for reasons outside of our control, be forced to discontinue or suspend your course. Where this is the case, a formal exit strategy will be followed in accordance with the student protection plan.

The Office for Students (OfS) is the principal regulator for the University.